Nearly every pharmaceutical sales and marketing organization shares the following belief: past script volume is a very good predictor of future script volume. This entrenched presumption has lead to the widespread use of historical prescribing behavior to segment physicians into prioritized groups (most commonly in the form of target deciles). IMS’s Xponent service line is largely considered to be the”gold standard” source of physician-level prescription data, however the increasingly available Medicare Part D dataset can also be effectively used for certain therapeutic areas.

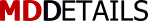

Let’s take the chronic obstructive pulmonary disease (COPD) market as our use case. For this particular indication, we can consider Part D data as an acceptable proxy for IMS (i.e., many severe COPD patients are covered through Medicare). In the chart below we describe the number of physicians composing the top four deciles for both primary care and pulmonology.

To keep things simple, let’s focus on the pulmonology callpoint moving forward. The deciling analysis points toward 350 high value pulmonologists who are responsible for 10% of the total branded drug scripts written each year. Likewise, another 600 individuals compose the next decile of total branded drug scripts within the COPD market. This segmentation is useful from a promotional perspective, as it provides guidance as to where efforts should be focused to drive the greatest impact.

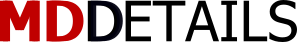

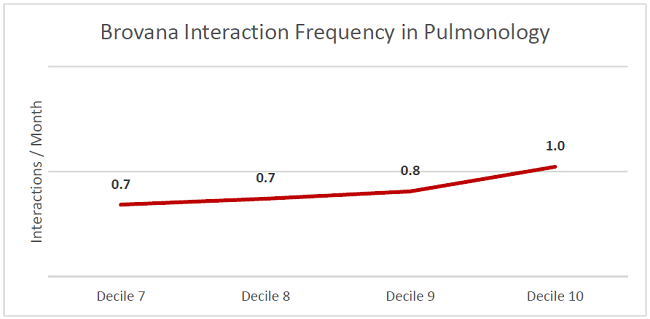

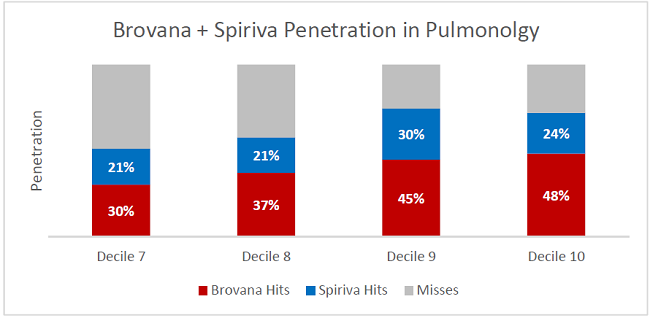

If we look at historical product detailing activity via the MDDetails platform it is clear that as expected, top decile physicians are the most heavily penetrated and most frequently detailed. We highlight paid physician engagement activity for Brovana (inhaled arformoterol tartrate) by decile in the charts below.

Note: Our analysis suggests that Sunovion was able to successfully detail 48% of the 350 pulmonologists in Decile 10.

Note: Our analysis suggests that on average, top decile physicians were engaged monthly by Sunovion reps.

These findings are relatively straightforward, but what is more interesting is the Sunovion “misses” in each decile. Are these individuals not reachable through paid promotion…or are they in fact accessible but have not been engaged by the Sunovion field team?

In order to provide some context around these “misses” we have layered in historical product detailing for another player in the COPD market – Boehringer Ingelheim’s Spiriva (inhaled tiotropium bromide). With this overlay it becomes clear that BI reps were able to access a subset of top decile physicians where Sunovion fell short. This is an important finding for the Brovana field team as it provides further clarity around rep access for high value COPD sales targets.

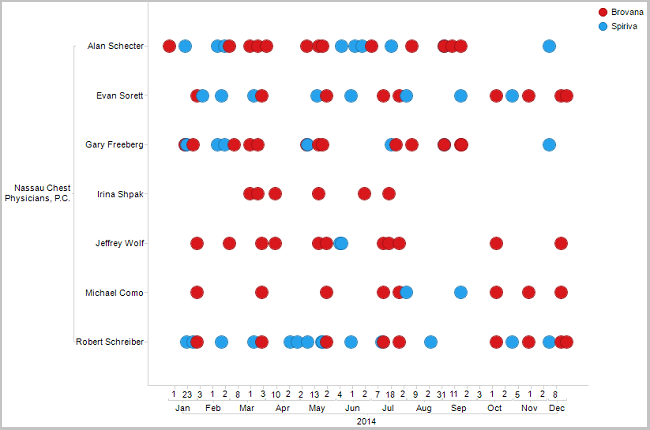

As a final component of the analysis, let’s take a practice-level look at detailing dynamics within New York state. The chart below highlights rep activity for Nassau Chest Physicians in Great Neck, NY (note that several of these physicians reside within the top two COPD deciles). This is a smaller, private practice that is actively engaged by both Brovana and Spiriva reps and is clearly competitive.

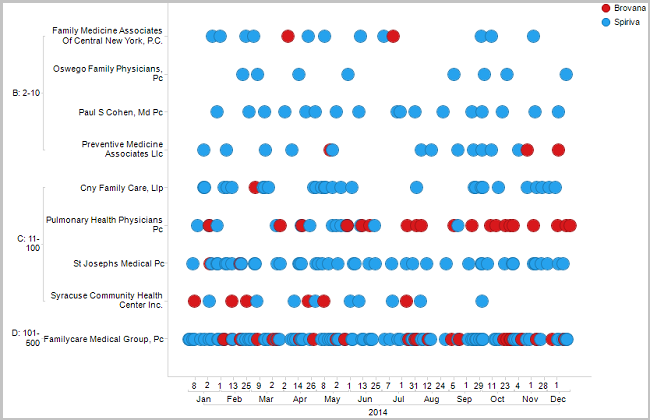

However, when we take a broader look at practices across central New York we start to see some potential issues for Brovana. In the set of practices below (selected based on presence of a top decile COPD physician), Spiriva shows good penetration across practices of all sizes. Brovana appears to have focused efforts within a subset of larger organizations. This may be a rational decision on Sunovion’s behalf (i.e., focus activity on areas with greatest “bang for your buck”) – but the combined dataset provides a better sense of the “detailing gap” and points toward high value practices and physicians where Sunovion might look to drive share of voice.

How we can help: The MDDetails platform offers a comprehensive set of paid physician engagement data that is complementary to the more traditional, script-based physician segmentation approach. When linked to established deciles, it can be leveraged to refine physician targeting and troubleshoot rep access challenges.