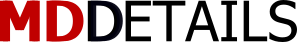

Recent publications, most notably the 2015 AccessMonitor survey, suggest that prescriber access has steadily fallen since 2008 and currently sits under 50% (See figure below, Source: ZS Associates).

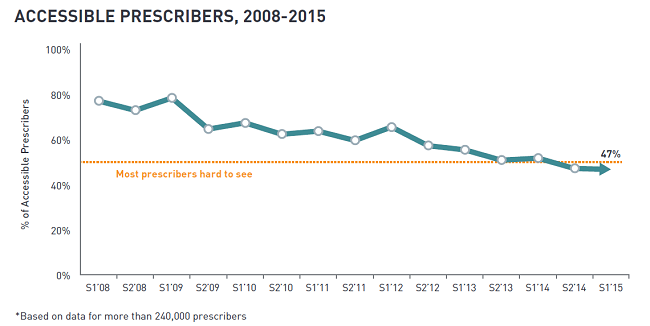

Our own analysis using the MDDetails platform (data on ~682,000 physicians) suggests that the 47% survey result reported by ZS is a fine representation of overall rep access to the 1M+ U.S. physician population. However, the more interesting story is the degree of variability in rep access across specialty. In the figure below we chart our prescriber access calculations against the total number of physicians in each specialty area.

Note: An accessible physician is defined by MDDetails as an individual who had at least one occurrence of in-person, paid promotional activity in the calendar year.

Our analysis suggests that a majority of specialties sit above (and in some cases well above) the 47% overall access rate quoted by ZS. While 10-15% may not seem to be a meaningful deviation from the pooled average, we would argue that it could have profound implications for physician targeting and engagement strategy.

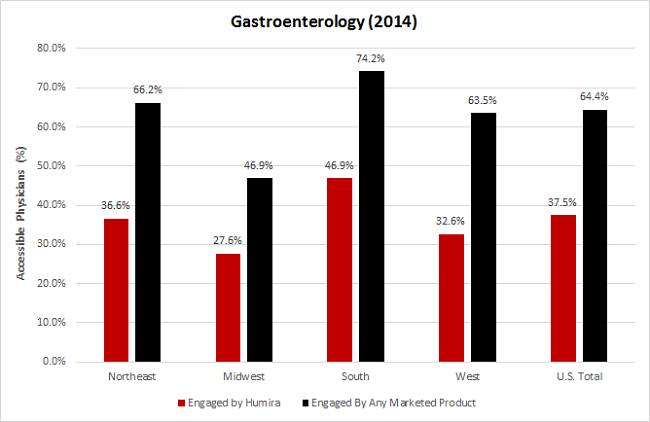

Furthermore, we’ve found that the variability goes beyond specialty area and is driven by geography as well. We’ve charted overall gastroenterology access by region in black bars in the figure below (the percentage represents aggregate access for the basket of 1,500+ products we track). As an illustrative example, the red bars represent Humira reach by region (The delta between the bars highlights accessible physicians not engaged by Humira).

Note: The above chart assumes 3,570, 2,860, 4,773, and 2,821 individuals in the Northeast, Midwest, South, and West, respectively. This accounts for a total of 14,024 physicians in gastroenterology. (Source: National Plan and Provider Enumeration System)

How we can help: It has never been more critical for drug and device makers to optimize promotional activities and physician engagement strategies. While the role of personal promotion will continue to evolve, we expect this channel to remain one of the most effective sales and marketing tools in the near-term. We can help to comprehensively characterize access at the specialty, region, and product level, by leveraging our data platform that includes over 682,000 U.S. physicians.