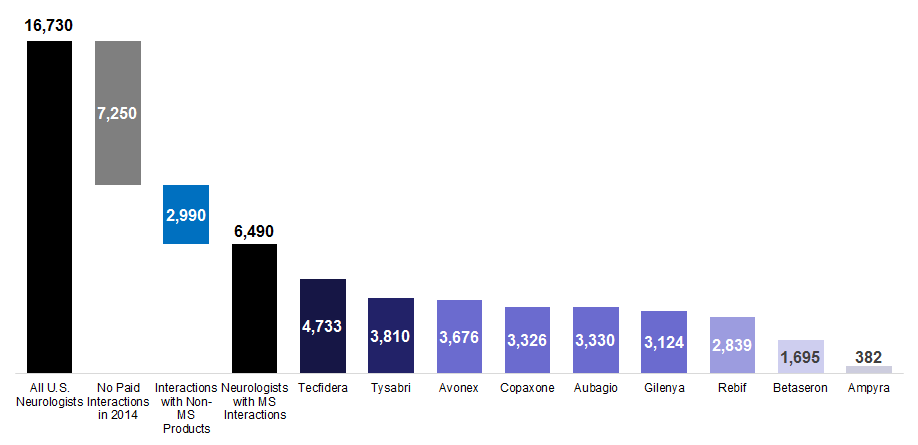

Multiple Sclerosis (MS) is one of the most competitive specialty markets we track, as a number of sophisticated players (i.e., Biogen, Teva, Sanofi, Serono, and Bayer) compete for a relatively small U.S. patient population. In the figure below we’ve charted coverage for each major product by leveraging the MDDetails platform to calculate the total number of neurologists accessed and engaged through paid promotion in the 2014 calendar year.

As a callpoint, neurology has relatively favorable sales rep / MSL access, with an estimated ~57% of individuals engaging through paid personal promotion activities (e.g., meals and education). However, a subset of ~2,990 accessible neurologists should be considered of low relevance for the MS market as these physicians are primarily engaged by non-MS products (e.g., dementia, migraine, pain, and seizure).

Observations

- Biogen owns the top three spots with Tecfidera, Tysabri, and Avonex. It presumably enjoys significant efficiency through detailing a portfolio of products to the same target prescribers. That said, Tecfidera is in a league of its own as it actively engages with ~900 more neurologists than any other MS product.

- The 3,200 – 3,800 neurologist window appears to be optimal coverage in the U.S., with most major products falling in this range

- Rebif, Betaseron, and Ampyra are laggards from a promotional perspective – the latter of which suffers from a relative lack of commercial resources compared to its peer set.

How we can help: MDDetails tracks prescriber access for more than 60 specialty areas and can provide a comprehensive view into promotional coverage at the product level.