Sales and marketing efforts behind a new drug launch can vary significantly by brand and this post highlights five distinct drug launch “phenotypes” observed through transparency data. These case studies are intended to provide an evidence-based perspective on how pharma companies are currently focusing efforts to engage healthcare providers…and how this varies based on company size, product novelty, competitive intensity and setting of care.

1: “The Bolus”

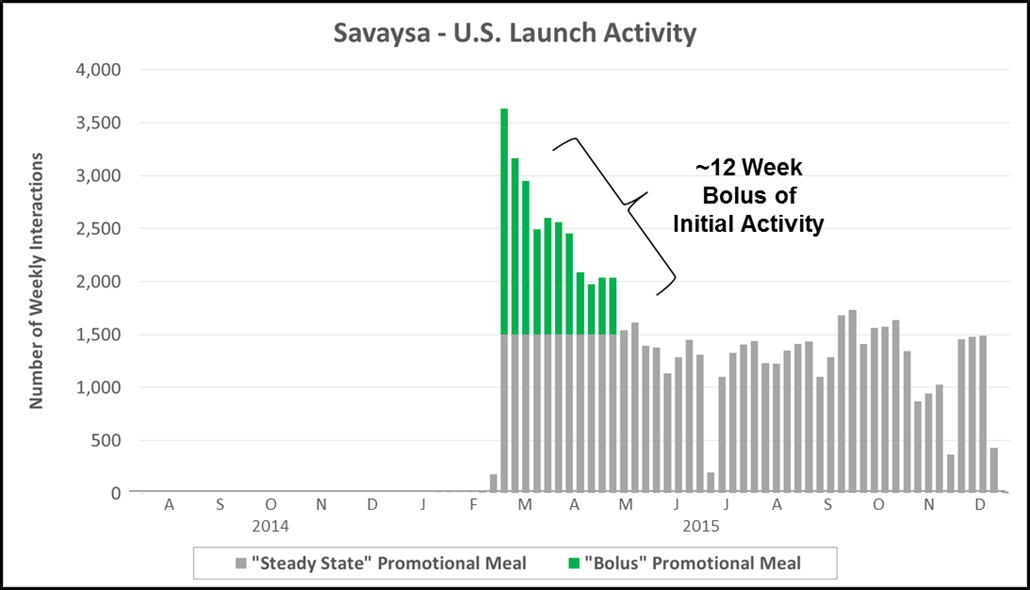

“The Bolus” in many ways is a vestige of the traditional pharma model built around an anticipated blockbuster. Although increasingly rare, this launch strategy is seen among top 20 pharma companies leveraging a large existing sales force to enter late into an established market. The chart below highlights reported personal promotional activity (e.g., paid physician meals) from Daiichi Sankyo’s launch of Savaysa (a 4th to market NOAC).

- Key Characteristics: Immediate bolus of paid promotional meals (e.g., lunch with sales rep detailing) upon approval, followed by a longer maintenance phase

- Where We See It: Top 20 pharma companies with a large existing sales force entering late into an established market

- Case Example: Daiichi Sankyo launched Savaysa (4th to market NOAC) by leveraging its existing cardiology sales force

- Other Recent Examples: Obesity (Saxenda and Contrave), Pain (Butrans), and Sleep (Belsomra)

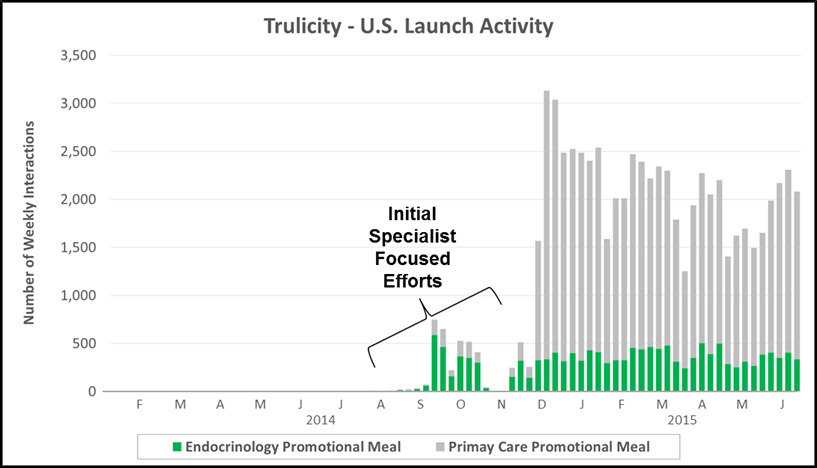

2: “The Specialist”

“The Specialist” has become increasingly common across major therapeutic categories in which a subset of specialized physicians have significant influence on standard of care. The chart below highlights personal promotional activity (e.g., paid physician meals) for Eli Lilly’s launch of Trulicity (a GLP-1 for Type II diabetes). Lilly focused almost exclusively on endocrinologists before later engaging a broader set of primary care physicians.

- Key Characteristics: Initial wave of promotional activity focused within a single specialty which later expands, typically into primary care

- Where We See It: Large categories where specialists have significant influence on standard of care and patient management

- Case Example: Eli Lilly used a staged rollout for Trulicity (injectable GLP-1) into T2D, focusing on endocrinologists during the first 12 weeks of launch

- Other Recent Examples: Grastek (Allergy), Fetzima (Psychiatry), Addyi (OB/GYN)

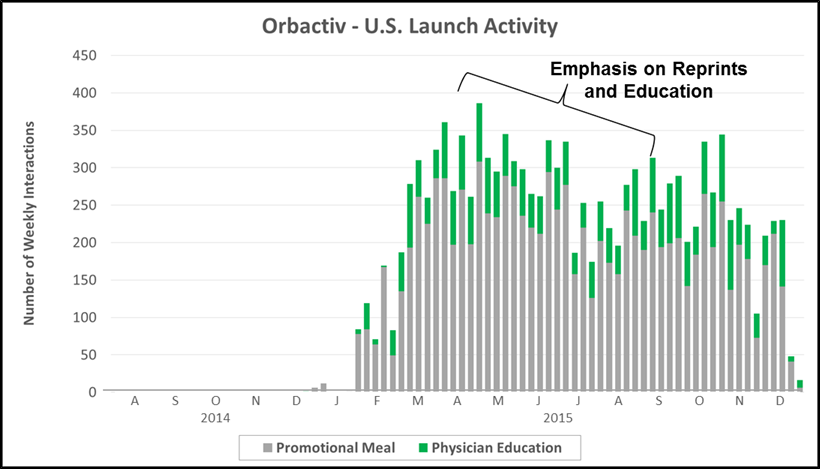

3: “The Reprint”

“The Reprint” which is often leveraged for hospital-focused products or in complex markets with nuanced patient types. The chart below highlights promotional activity for the Medicine Co’s launch of Orbactiv into the severe infection market. Physician education (e.g., journal reprints and clinical case studies) played a significant role in the first year of launch – aimed at driving awareness of Orbactiv’s efficacy and target patient populations.

- Key Characteristics: Emphasis on physician education (e.g., reprints or case studies) combined with paid promotional meals (e.g., sales rep detailing)

- Where We See It: Hospital products and/or complex markets with nuanced product labels or patient types

- Case Example: The Medicines Co. included a significant education component for its 2014 launch of Orbactiv into the complex severe infection market

- Other Recent Examples: Anti-infectives (AvyCaz), Hospital (Ionsys), Multiple Sclerosis (Plegridy)

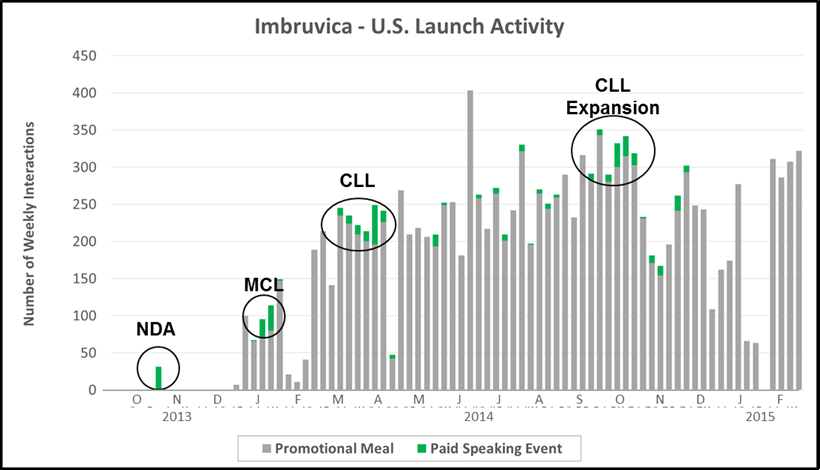

4: “The Podium”

“The Podium” is generally employed to launch novel therapies (e.g., new MOA), often times into orphan/rare disease markets. In the chart below we highlight paid speaking activity for J&J/Pharmacyclics’ launch of Imbruvica. Interestingly, a recurring cast of ~80 high profile speakers were engaged to drive product awareness around key inflection points for the product (e.g., NDA filing, initial approval, and indication expansion).

- Key Characteristics: Orchestrated physician speaker bureaus, often aligned with key clinical readouts or label expansions

- Where We See It: Orphan/rare diseases or launch of a new mechanism of action

- Case Example: Pharmacyclics/J&J worked with a roster of ~80 speakers to rollout Imbruvica (first in class BTKi) into the hem malignancy market in 2013

- Other Recent Examples: Oncology (Lynparza, Keytruda Ibrance), Rare Disease (Kanuma, Strensiq), Cardiology (Praluent, Repatha)

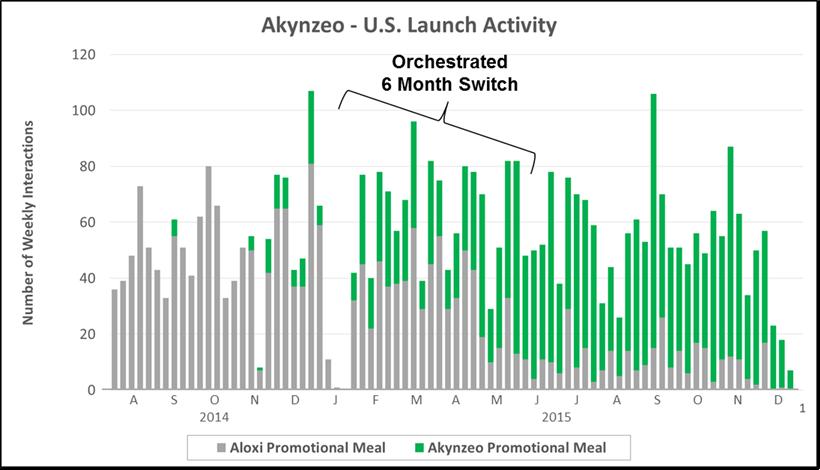

5: “The Switch”

“The Switch” requires the simultaneous sun setting of a legacy product and ramp up of a replacement product that plays in the same market. The chart below highlights promotional activity for Eisai’s Aloxi and Akynzeo. Importantly, Eisai executed a ~6 month promotional “switch” from Aloxi to Akynzeo within the CINV market.

- Key Characteristics: Simultaneous sun setting of a legacy product and ramp up of a replacement product that plays in the same market

- Where We See It: Life cycle plays (e.g., patent expiry) or incremental innovations within a fast moving market (e.g., drug/device or combos)

- Case Example: Eisai executed an orchestrated 6 month replacement of expiring Aloxi with Akynzeo in the CINV market

- Other Examples: Gazyva (from Rituxan), Toujeo (from Launtus) Harvoni (from Sovaldi), Stiolo Respimat (from Striverdi Respimat)

Putting it All Together

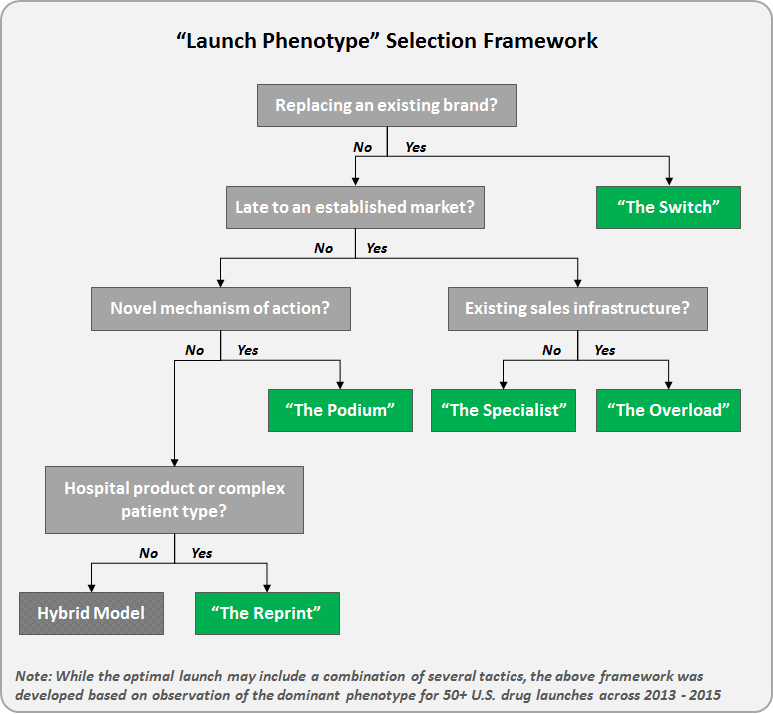

While most new drug launches will ultimately require a multi-faceted rollout, taken collectively these observed phenotypes can provide a working framework to guide marketers to key tactics that should be featured based on specific market conditions/scenarios.